fit on paycheck stub

Other groups such as. What does fit mean on a payroll check stub.

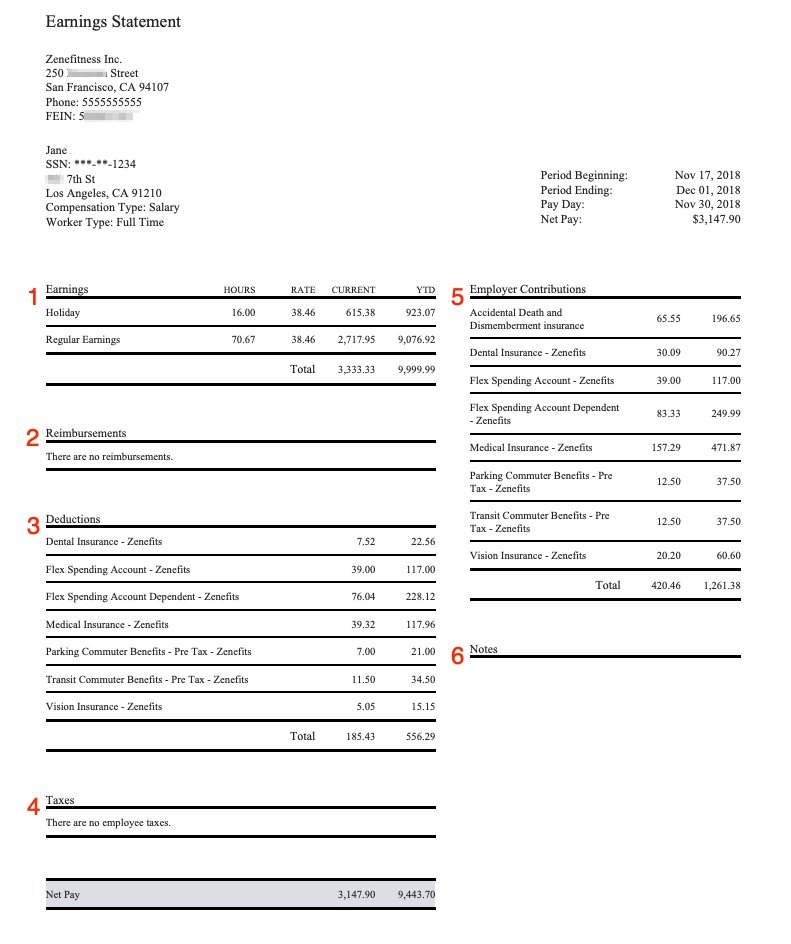

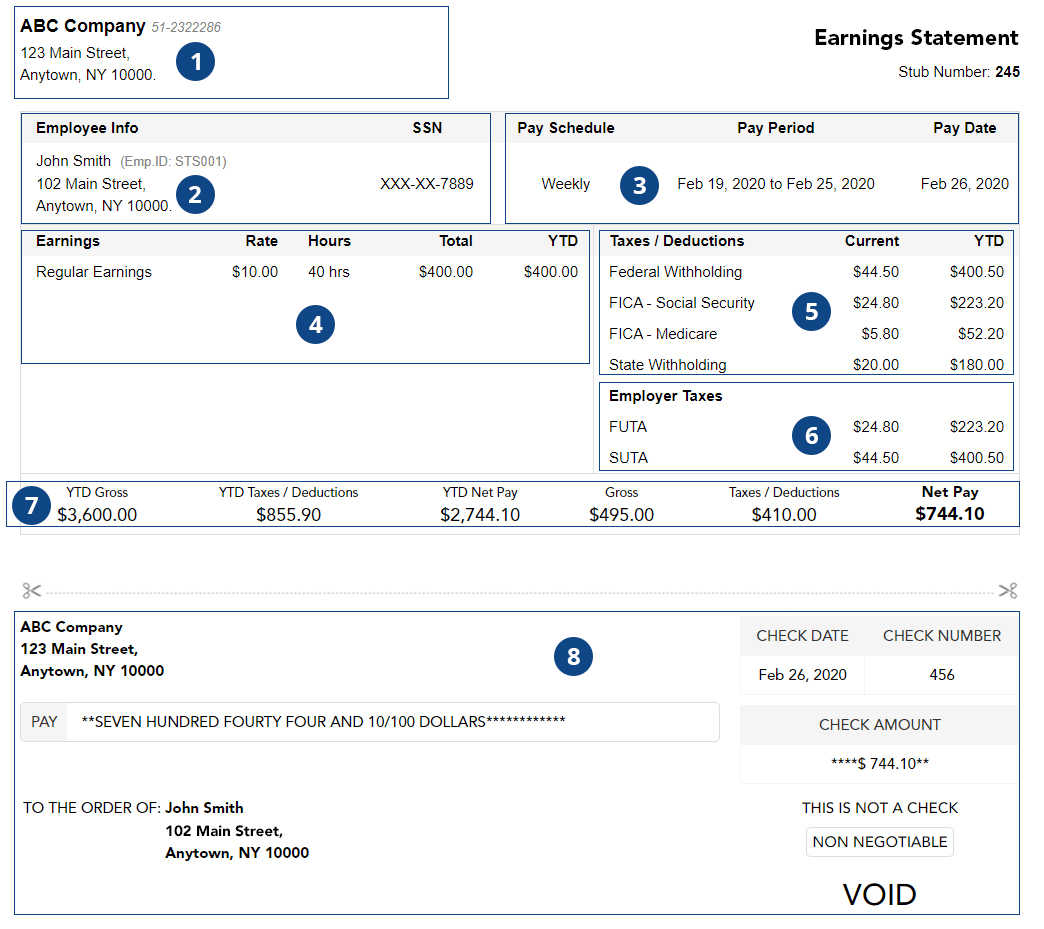

What Does A Pay Stub Look Like Workest

The employees W-4 form and.

. You can skip this step if you have already created paychecks. Decoding Pay Stub Abbreviations. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may exist for that employee. Here is a list of the abbreviations youll usually find in the header of your paycheck stubs. In the United States federal income tax is determined by the Internal Revenue Service.

Calculate Federal Income Tax FIT Withholding Amount. This is the amount of money earned during the pay period. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. How to calculate taxable wages. Your net income gets calculated by removing all the deductions.

FIT is applied to taxpayers for all of their taxable income during the year. I just received my first paycheck at a new job I started two weeks ago I have a 65000year salary - the base earnings for 40 hours is 1250. The name of the Employee.

How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. Make sure you have the table for the correct year.

General Pay Stub Abbreviations. One withholding employees see listed on their earnings statements is the Fed MEDEE Tax. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

A copy of the tax tables from the IRS in Publication 15. The paycheck stub header is where youll find your name and address pay period the address of your company or employer and your Social Security number. Some are income tax withholding.

How is fit calculated on paycheck. Federal Income Tax. The Employees social security number.

TDI probably is some sort of state-level disability insurance payment eg. Answer 1 of 2. Take a look at your pay stubany amount labeled as FICA is a contribution to those two federal programs.

FIT deductions are typically one of the largest deductions on an earnings statement. The employees adjusted gross pay for the pay period. FIT is applied to taxpayers for all of their taxable income during the year.

Your pay stub will also show how much youve earned during the year so far and for that pay period. What is the website for Outback employees pay check stub. To calculate Federal Income Tax withholding you will need.

Paycheck Stub Abbreviations for Earnings. FIT means federal income taxes. While the task of figuring out FIT withholdings for your employees may seem tricky with the help of Block Advisors payroll service or payroll software like Wave your payroll to-dos just got easier.

A company specific employee identification number. Gross wages are the starting point from which the. Because FIT taxable wages can be tricky to calculate lets walk through the process in detail.

What is the website to print out my check stub from Outback. Some entities such as corporations and trusts are able to modify their rate through deductions and credits. The rate is not the same for every taxpayer.

FICA means Federal Insurance Contribution Act. FIT Fed Income Tax SIT State Income Tax. Fit stands for federal income tax withheld.

This is just a way to save time and space on your pay stub. You pay 62 of your income to Social Security SS. Generate paycheck automatically or manually Optional You can generate a new check by using tax tables or you can enter the taxes data manually.

Fit stands for Federal Income Tax Withheld. Some check stubs break out Social Security and Medicare payments to show you how much youre contributing to each fund. But when you are trying to decipher it all it can look pretty intimidating.

This is the amount of money an employer needs to withhold from an employees income in order to pay taxes. FIT is withheld from an employees paycheck based on the amount of their federal taxable wages. FIT on a pay stub stands for federal income tax.

SSN Social Security number. Based on Publication 15-T 2021 Federal Income Tax Withholding Methods you can use either the Wage Bracket Method or the Percentage Method to calculate FIT. It covers two types of costs when you get to a retirement age.

They go toward costs needed to run the federal government. Withholding is one way of paying income taxes to the. What is FMED on my paycheck.

1 medicare and 2 social. These items go on your income tax return as payments against your income tax liability. FIT deductions are typically one of the largest deductions on an earnings statement.

Ariel SkelleyBlend ImagesGetty Images. I expected - for a two week pay period - to get around 1800 but the deductions included 79125 for CT SIT 38462 for FIT 3625 for MCEE and 105 for TSSE - the last two deductions I have no clue. Federal Income Tax FIT is calculated using the information from an employees completed W-4 their taxable wages and their pay frequency.

On your pay stub youll see some common payroll abbreviations and some that arent so common. Here are some of the general pay stub abbreviations that you will run into on any pay stub. You are going to see several abbreviations on your paycheck.

Below are some items that are usually listed on a pay stub. Select paychecks from list. Heres the lowdown on FICA.

Pin On Beautiful Professional Template

A Guide On How To Read Your Pay Stub Accupay Systems

Lovely Sonic Paycheck Stubs Author S Purpose Worksheet Authors Purpose Certificate Templates

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

A Pay Stub Or Paycheck Stub Is A Document That Is Issued To By An Employer To His Her Employee As A Notification That P Payroll Checks Payroll Payroll Template

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

Pin On Beautiful Professional Template

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Pay Stub Copy Generator Pdfsimpli

Modern Paystub Template Free Checking Paycheck Templates

Understanding Your Paycheck Credit Com

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Understanding Pay Stub Understanding Paycheck Stub

Decoding Your Pay Stub Infographic Money Management Decoding Understanding Yourself